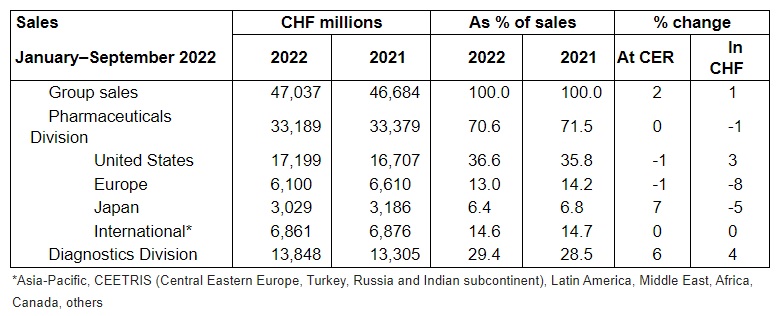

Group sales up 2%1 at constant exchange rates (CER) and 1% in Swiss francs; as expected, significantly lower COVID-19-related sales in both divisions in the third quarter

Sales in the Pharmaceuticals Division at the previous year’s level with significantly lower sales of COVID-19-related products (Ronapreve and Actemra/RoActemra) and losses to biosimilars, offset by strong growth of newer medicines

Sales in the Diagnostics Division rise 6%; base business remains strong; as expected, demand for COVID-19 tests sharply down in third quarter

Highlights in the third quarter:

EU approval for Vabysmo (severe eye diseases)

US approvals for Xofluza (influenza in children)

Launch of a digital PCR diagnostic platform and of COVID-19, skin and breast cancer tests

“Breakthrough Device Designation” granted for Alzheimer’s blood tests

Outlook for 2022 confirmed

Severin Schwan, CEO of Roche: “Group sales grew 2% despite the expected sharp decline in COVID-19-related products in both divisions in the third quarter. The demand for our newer medicines for multiple sclerosis, haemophilia, spinal muscular atrophy and cancer remains high. I am particularly pleased that so many patients with severe eye disease have already accessed our new medicine Vabysmo and started treatment. Likewise, our Diagnostics Division base business continued to grow strongly. Based on our current assessment, we confirm the outlook for the full year.”

Outlook for 2022 confirmed

Roche expects stable sales or sales growth in the low-single-digit range (at constant exchange rates). Core earnings per share are targeted to grow in the low- to mid-single-digit range (at constant exchange rates). Roche expects to increase its dividend in Swiss francs further.

Group sales

In the first nine months, the Roche Group generated sales growth of 2% (1% in CHF) to CHF 47 billion.

As expected, the third quarter of 2022 was particularly challenging due to base effects, as the demand for COVID-19 medicines and tests was exceptionally high in the same quarter of 2021.

Sales of the Pharmaceuticals Division were at the same level as in the previous year, at CHF 33.2 billion.

The newer medicines Ocrevus (multiple sclerosis), Hemlibra (haemophilia), Evrysdi (spinal muscular atrophy) and Phesgo (breast cancer) continued their strong growth. The eye medicine Vabysmo, which was only launched at the beginning of the year, is now also one of the strongest growth drivers. These top-five medicines alone generated additional sales totalling CHF 2.2 billion.

As expected, sales growth was offset by the biosimilars-related decline in sales, especially for the established cancer medicines Avastin, MabThera/Rituxan and Herceptin. Sales of Actemra/RoActemra and Ronapreve (COVID-19) were also significantly lower than in the same period of 2021, with a decline of roughly CHF 1 billion, as the pandemic continued to weaken in many countries in 2022.

Sales in the United States decreased slightly with 1%. Growth of Ocrevus, Hemlibra, Vabysmo, Xolair and Tecentriq partially offset lower sales of Actemra/RoActemra, Avastin, Herceptin, MabThera/Rituxan, Lucentis and Esbriet.

In Europe, sales were also slightly down by 1%. The main reason for this was the decline in sales of the COVID-19 medicine Ronapreve compared to the previous year. Excluding this base effect, sales in Europe grew by 6%.

Sales were up in Japan (+7%), mainly due to supply of Ronapreve to the government, followed by sales growth of Evrysdi, Hemlibra, Polivy and Enspryng. This more than offset the impact of government price cuts and biosimilars.

Sales in the International region were stable. The impact of biosimilars and decline in sales of Actemra/RoActemra was compensated by Perjeta, Kadcyla, Hemlibra and Ocrevus sales.

The Diagnostics Division generated a 6% increase in sales to CHF 13.8 billion. The division’s base business continued its strong sales growth across all regions (+6%), with the largest contributions coming from the Europe, Middle East and Africa (EMEA) and Asia-Pacific regions. Immunodiagnostic products were the main growth drivers.

As expected, the demand for COVID-19 tests declined sharply in the third quarter of 2022 (CHF 0.6 billion versus CHF 1.0 billion in the same period last year).

Sales in the Asia-Pacific and North America regions increased strongly, by 28% and 20%, respectively. The 13% decline in sales in the EMEA region is primarily due to the lower demand for COVID-19 tests.

Pharmaceuticals: key approvals and development milestones in the third quarter of 2022

Ophthalmology

In September, the European Commission (EC) approved Vabysmo, the first bispecific antibody for the eye. Vabysmo simultaneously targets and inhibits two disease pathways that drive neovascular or ‘wet’ age-related macular degeneration (nAMD) and diabetic macular oedema (DME) – two of the leading causes of vision loss. With the potential to require fewer eye injections over time, while also improving and maintaining vision, Vabysmo could offer a less burdensome treatment schedule for individuals, their caregivers and healthcare systems.

Oncology

In August, the FDA accepted the supplemental Biologics License Application (sBLA) for the Polivy combination therapy for previously untreated diffuse large B-cell lymphoma (DLBCL), an aggressive form of blood cancer. In four out of ten people with DLBCL, the cancer returns after initial treatment, at which point treatment options are limited and survival is short. Later in August, the Japanese health authorities granted approval for this Polivy combination in previously untreated DLBCL.

Also in August, Roche announced that the IMscin001 study met its co-primary endpoints. The study evaluated a subcutaneous formulation of cancer immunotherapy Tecentriq in people with advanced non-small cell lung cancer. Administered under the skin, this new formulation reduces the time spent receiving treatment to a matter of minutes, compared with up to an hour for an infusion.

Neuroscience

In October, Roche presented new data from its expanding neuromuscular disease portfolio. New two-year Evrysdi data show improvement or maintenance of motor function in people with spinal muscular atrophy (SMA). SMA is a severe, progressive neuromuscular disease that can be fatal. It is the leading genetic cause of infant mortality.

In addition, data from the gene therapy EMBARK study for Duchenne muscular dystrophy (DMD), the most advanced phase III study currently underway, reinforces our confidence in the programme. DMD is a rare, progressive neuromuscular disease, leading to a loss of muscle function and premature death.

Virology

In August, the FDA approved Xofluza for the treatment of acute uncomplicated influenza in otherwise healthy children aged five years and older. Historically, school-aged children have played a significant role in the community transmission of influenza. This approval marks the first single-dose oral influenza medicine approved in the US for children. Additionally, the FDA approved Xofluza for the prevention of influenza in children following contact with someone with influenza.

Pharmaceuticals: key development milestones in the third quarter of 2022

Diagnostics: key milestones in the third quarter of 2022

In July, the FDA granted Breakthrough Device Designation to the Elecsys Amyloid Plasma Panel, an innovative new solution that enables Alzheimer’s disease to be detected earlier. This panel measures two blood-based biomarkers, called pTau 181 and ApoE4. It has the potential to streamline a patient’s journey and increase the speed of diagnosis, giving people living with Alzheimer’s disease and their caregivers more time to plan and prepare for the future.

In August, Roche launched the Digital LightCycler System. This next-generation digital PCR system helps clinical researchers better understand the nature of a patient’s cancer, genetic disease or infection. It has the potential to find and quantify ultra-rare, hard-to-detect disease mutations, leading to early diagnosis and therapy decisions.

Every four minutes, one person dies from skin cancer. However, when detected early, localised melanoma is curable with a simple surgical excision. The newly launched PRAME (EPR20330) Antibody test evaluates PRAME protein expression from patients with suspected melanoma. Identifying this critical biomarker helps clinicians determine if their patient has melanoma.

Approximately half of all patients with metastatic breast cancer express low levels of HER2 receptor protein. The newly launched PATHWAY anti-HER2 (4B5) test is the only FDA-approved companion diagnostic indicated as an aid in the assessment of HER2 low status in these patients. Historically these patients have simply been classified as HER2-negative, leaving them with few treatment options. They may now be eligible for targeted therapy.

With the launch of additional COVID-19 tests, Roche also reinforced its position as a world-leading supplier of COVID-19 diagnostics:

The Elecsys IGRA SARS-CoV-2 test can help provide a deeper understanding of a person’s immune response to SARS-CoV-2 infection or vaccination. It will serve as an additional tool to make better-informed decisions around care, sanitary measures and treatment options – particularly important for at-risk patient groups.

(The test was launched in countries that accept the CE Mark.)

The next generation portfolio of SARS-CoV-2 Rapid Antigen tests (“2.0”) for self-testing and professional use feature innovative updates and enhanced performance, building on insights gained throughout the pandemic.

(These tests are used under the CE mark.)

Based on continuous analysis performed since the onset of the pandemic, all Roche molecular tests detect all SARS-CoV-2 variants.

Pharmaceuticals sales

About Roche

Roche is a global pioneer in pharmaceuticals and diagnostics focused on advancing science to improve people’s lives. The combined strengths of pharmaceuticals and diagnostics under one roof have made Roche the leader in personalised healthcare – a strategy that aims to fit the right treatment to each patient in the best way possible.

Roche is the world’s largest biotech company, with truly differentiated medicines in oncology, immunology, infectious diseases, ophthalmology and diseases of the central nervous system. Roche is also the world leader in in vitro diagnostics and tissue-based cancer diagnostics, and a frontrunner in diabetes management.

Founded in 1896, Roche continues to search for better ways to prevent, diagnose and treat diseases and make a sustainable contribution to society. The company also aims to improve patient access to medical innovations by working with all relevant stakeholders. More than thirty medicines developed by Roche are included in the World Health Organization Model Lists of Essential Medicines, among them life-saving antibiotics, antimalarials and cancer medicines. Moreover, for the twelfth consecutive year, Roche has been recognised as one of the most sustainable companies in the Pharmaceuticals Industry by the Dow Jones Sustainability Indices (DJSI).

The Roche Group, headquartered in Basel, Switzerland, is active in over 100 countries and in 2020 employed more than 100,000 people worldwide. In 2020, Roche invested CHF 12.2 billion in R&D and posted sales of CHF 58.3 billion. Genentech, in the United States, is a wholly owned member of the Roche Group. Roche is the majority shareholder in Chugai Pharmaceutical, Japan