Indian Pharmaceutical Market

Indian pharmaceutical industry is valued at USD 39 Bn in 2019 and 50% of the market is primarily driven by exports to regulated as well as semi-regulated markets. Currently, India exports drugs to more than 200 countries and vaccines and bio-pharma products to more than 150 countries. Globally, India ranks 3rd in terms of volume and 10th in terms of value.

The country is home to more than 3,000 pharma companies with a strong network of over 10,500 manufacturing facilities. Indian pharmaceutical industry is highly fragmented with top 20 companies contributing to 50% of total sales. Urban regions (Metros and Tier I cities) contribute to about 60% of total sales. Tier I cities are growing at ~9% p.a. while rural areas are growing at ~14.5% p.a. The growth has been driven by increased access to healthcare, improved infrastructure and greater penetration of pharmaceutical companies into Tier 1 cities and rural areas.

If we track our journey, in early 1990s India was self-sufficient to produce both formulations as well as API. However, in the last two decades, we have completely metamorphosed. And, today 70% of our API comes from China as it is priced 20-30% cheaper than made in India. This is because China has world scale plants, lower finance cost, better output thus reducing labour cost per unit produced and benefits of various other duty drawback and tax sops.

Today, though supplies from China have stabilised and is near normal to pre-COVID volumes, prices of some APIs have increased by 25-30% making India to re-think its make or buy strategy for API and KRM inputs.

Changing market dynamics

Past 7 years has seen deceleration of pharma industry growth rate from 16.6% in 2012 to 9.8% in 2019. During these years, the industry faced a different type of regulatory headwind; the patent office ruled against the intellectual property rights for several notable drugs. A still more daunting challenge for MNCs operating in India has been compulsory licensing and uncertainty about patent validity. Domestic companies, on the other hand, have been equally impacted by the Drug Prices Control Orders. The Parliamentary Standing Committee recommended multiple mandatory conditions for allowing FDI in brownfield projects while allowing 100% FDI in Greenfield projects.

Industry estimates show that generic drug user fee amendments in USA, compulsory licencing and national pharmaceutical pricing policy have increased the legal expenditures of the top 10 drug makers in India by ~50% in the past three years.

With the notification of the order, till date the NPPA has brought almost 1000 drugs under NLEM, which accounts for 60 percent of total domestic pharmaceutical market amounting to nearly USD 12 Bn under price control. NPPA has led to value erosion to the tune of 20% post implementation.

On the other hand to circumvent domestic challenges Indian players have looked at opportunities in West. India has over 1000 US FDA manufacturing sites, which is maximum in single country outside US. As per IQVIA data the share of Indian companies in total generic prescriptions rose to 45% in the March quarter of 2018. It is observed that over the years, Indian companies have been gaining market share in US generics. But the pace of gain has increased significantly starting early 2018 when Teva, the largest generic player, decided to exit certain non-profitable products.

In last decade Indian pharma companies enhanced their investments in research and development (R&D) and successfully received higher approvals from the US FDA. Out of total 5,350 ANDA approvals between 2009 to 2018, Indian companies have secured 34.4% of these approvals and received total 1,842 ANDA final approvals. Further, out of total 1,310 tentative approvals, Indian companies grab 500 tentative approvals from USFDA which worked out to over 38.2%.

Today, COVID 19 is the biggest disrupter of supply chain and market demand. Demand for Cardiac drugs, Anti-Diabetic and the Respiratory drugs saw higher demand due to Covid-19 as the virus is known to impact this critical function of the human body. While segments like Derma and Gynaec, where the demand for drugs has always remained ahead of others declined. Also, demand for products linked to COVID 19 precaution like immune busters, vitamins B, C & D, antivirals and steroids have gone up significantly. India clearly indicate that the industry is going through a period of significant volatility and uncertainty which has created a new normal for the companies.

In such an uncertain playing field where you don’t know how long this select surge in demand will stay, it is imperative for companies to ask “How do we grow our business from here?” I believe this is the right time for companies to reinvent their business model or take on some disruptive new approach as traditional strategic approach would have limitation in this transient world.

Strategies for success in uncertain and volatile environment

I believe that companies which quickly adapt to the uncertain and volatile environment and identify right opportunities will be the possible winners in 2020 and beyond

Review product portfolio

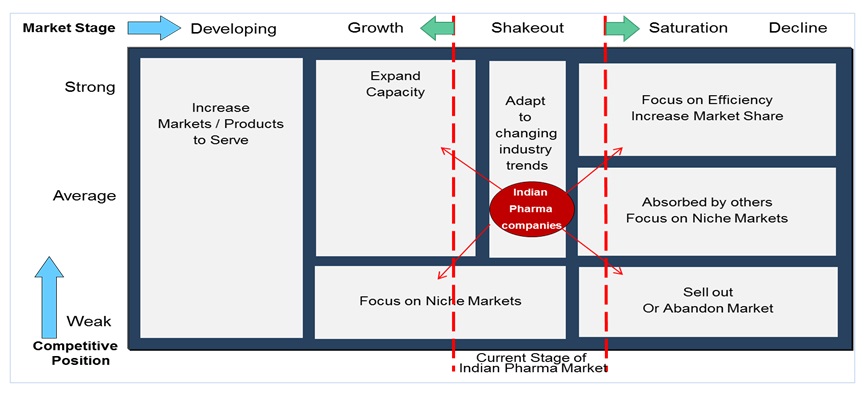

Above framework is a very handy tool to map product portfolio by Therapeutic Areas (TAs) and map each products Market Stage based on Drug Life Cycle it is currently in and evaluate Competitive Intensity in that market to map your position. So if your product falls in:

Developed market stage: Whatever your competitive position is focus on expanding your market presence by new customer and new geography. Also re-look at product extensions, packaging innovation (Compliance packaging), drug delivery as differentiators.

Growth market stage: If your competitive strength is strong focus on capacity expansion and scale. If competitive position is week then focus on niche market and build customer relationship.

Saturation or Decline market stage: In this stages if your competitive strength is high focus on efficiency and gain market share and if your competitive strength is low better look for selling out tail products.

Besides above, it will be vital for companies to re-look at its geographic spread and to re-new their portfolios by focusing on; therapeutic class synergies, increasing share of prescription, adding innovative and better margin products.

Build customer centricity

To succeed in such a complex environment, companies will need to take a customer centric view to re-look at the value proposition for each major customer segments. For each customer segment in the value chain, be it channel partners, practicing physicians, or direct patients, companies need to look at building distinctive forms of customer connect through advanced mechanisms of sales force engagements, consolidation of field force, strengthen marketing channels with adoption of digital marketing, and organize patient education programs for chronic diseases. Companies should not just promote their products but see themselves as a disease prevention and management company by building community based approach.

Strengthen operational capability

Companies will need to revisit their operations to ensure that no complacency has set in. The legacy processes might be driving up costs due to outdated technologies or high e-factor1. Companies will need to focus on process innovations by adopting latest technologies such as micro reactors or critically evaluating and reducing the number of process steps. Furthermore, benchmarking of manufacturing processes and supply chain optimization will help in establishing the extent of improvement required to be achieved by the company.

Value creation by Alliances / M&A

Companies need to look for inorganic value creation and speed to market opportunities. Alliances could help in deeper customer and market penetration with value creation happening in many forms such as co-production to reduce compliance costs, co-marketing through use of common marketing channels and co-promotion to reduce advertisement & promotion costs by leveraging common distribution channels. It will also help companies to capitalize on licensing opportunities presented by international pharmaceutical players as they increasingly invest in emerging economies.

Build Agile Organization

To successfully respond to uncertainty, companies will have to create a culture of agility and innovation. They will need to take a fresh look at their organizational structure, especially the number of layers in the organization, the relationship between business units, and the mix of organizational boundaries. They will need to significantly redefine business processes to enable quick decisions and lower cycle times while also meeting increased compliance requirements. The leadership team and senior management will also have to be trained to accept the new normal as a “way of life” and respond to change quickly.

Conclusion:

COVID 19 has given opportunity to all industries and pharmaceutical industry in particular to re-visit its strategies. To meet the new normal, companies will have to invest in re-establishing their competitive position. Optimization of product portfolio to target high return products and building distinguishing capabilities to stay ahead of competition would be the key to success.

Both domestic and multi-national players will need to look at inorganic growth opportunities including value creation through partial carve outs as it would play a key role in defining the long term sustainability of the companies. The winning companies will be the ones which analyze their competitive position and meet the rapid changes happening in the industry by evaluating and speedily implementing the suggested levers outlined above.

References

1. CII India Pharma Inc Report

2. IBEF Pharmaceutical industry report

3. ICRA report on pharmaceutical industry

4. Deloitte Indian Pharmaceutical Industry Report

5. Web articles – Express Pharma, Pharma Bio-world, Forbes